What is it, and What Does it Cover?

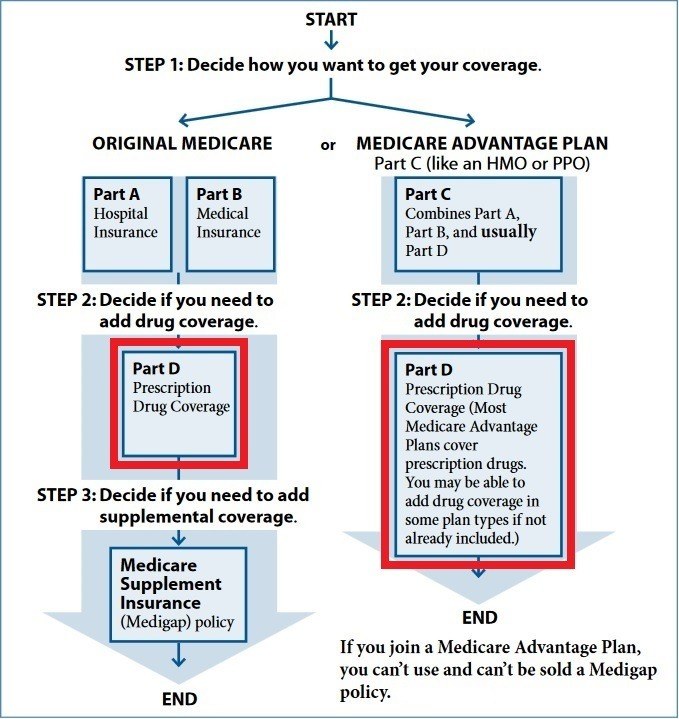

Part D of Medicare is for prescription drug coverage. An easy way to remember this part of Medicare is that “D” stands for “drugs”. Keep in mind that Part D applies towards self-administered, prescription drugs; drugs that are administered in a medical facility or provider’s office can often be covered under Medicare Part B. Examples of this would be chemotherapy drugs and medications administered intravenously in a doctor’s office. See the block diagram below, and note that there are two ways to get Part D:

One way to get Part D is in a “stand alone” prescription drug plan (PDP). If you decide to get a Medigap policy then you can get a PDP to go along with it. You would use your Medigap insurance along with Original Medicare when you go to the doctor or hospital or for other medical needs; you would use your PDP when you go to fill your prescriptions at the pharmacy.

The other way to get Part D is included in a Medicare Advantage plan. These plans are often known as MAPDs. You would use this plan then for doctor, hospital, other medical, and prescription coverage together. It would be a comprehensive managed care plan.

How Much Does it Cost?

Monthly premium

PDP plans are provided by insurance companies and their premiums can vary significantly from plan to plan. Also, if your Modified Adjusted Gross Income (MAGI) is above $88,000 as an individual or above $176,000 as a married couple, you will have an additional Income Related Monthly Adjustment Amount, or IRMAA. This just means you have to pay a bit extra in a premium for your Part D plan whether it’s provided in a PDP or MAPD. The chart below shows how much extra your IRMAA is based on how much your MAGI is. Social Security calculates your IRMAA for the current year based on the MAGI from the most recent federal tax return that the IRS has provided them. So, for example, your 2021 IRMAA is based on your MAGI from 2019.

Individual Tax Return MAGI | Joint Tax Return MAGI | Married Filing Separately MAGI | Part D Monthly Premium |

|---|---|---|---|

$88,000 or less | $176,000 or less | $88,000 or less | Your plan premium |

$88,001 - $111,000 | $176,001 - $222,000 | n/a | $12.30 + your plan premium |

$111,000 - $138,000 | $222,000 - $276,000 | n/a | $31.80 + your plan premium |

$138,000 - $165,000 | $276,000 - $330,000 | n/a | $51.20 + your plan premium |

$165,000 - 499,999 | $330,000 - $749,999 | $88,001 - $411,999 | $70.70 + your plan premium |

$500,000 or above | $750,000 and above | $412,000 and above | $77.10 + your plan premium |

Deductible

Some of the plans have deductibles and some don’t. The maximum annual deductible that any Part D plan can have is $445 in 2021. If you sign up for a plan that has a deductible, that means you pay 100% of the retail cost of the prescription before the insurance company starts to pay for part of the cost. However, some companies will charge deductibles for only certain drug tiers, and cover drugs in other tiers even before you meet your deductible.

Coinsurance and Copays

After you meet the deductible, you often still have a portion to pay of the retail drug cost and the insurance company will pick up the rest. If your portion is a percentage of the drug cost, that would be your coinsurance; if your portion is a flat dollar amount, that is called your copay.

There are four phases of coverage to a Part D plan:

- Phase 1 - Deductible: the deductible is considered Phase 1 of a Part D plan. Again, some Part D plans have no deductible to meet.

- Phase 2 – Initial Coverage Level: once you meet the deductible, you’re now in the Initial Coverage Level Phase where you now share in the cost of the medications (copays or coinsurance) with the insurance company.

- Phase 3 – Coverage Gap or Donut Hole: Once the total retail cost of your prescriptions reaches $4,130 in 2021, you now enter into the Donut Hole. Overall, the amount you spend on your medications will go up. The maximum you spend is 51% of the cost of a generic drug or 40% of the cost of a brand name drug in 2021. Something to note about the Donut Hole is that it will be eliminated by 2021. At that point, your cost sharing will be the same as it is in the Initial Coverage Level now.

- Phase 4 – Catastrophic Coverage: Once your True-Out-Of-Pocket (TrOOP ) costs reach $6,550 for the year, your copays will decrease substantially compared to the Donut Hole. You’ll then be responsible for either 5% of the retail drug cost or $3.70 copay for generic/$9.20 copay for a brand name drug, whichever is cheaper. Your TrOOP is calculated by adding any amount you spend on a deductible, any copays or coinsurance you pay in the Initial Coverage Level, any copays or coinsurance you pay in the Donut Hole, plus 50% of the retail cost of any brand name drug in the Donut Hole. When this total exceeds $6,550 for the year you will enter Phase 4.

So, it’s crystal clear now, right? You’re probably thinking, “Yeah, clear as mud”. Well don’t sweat it. Your Part D insurance company will send you monthly statements showing your costs and what they paid for the month, and tally up your annual totals month-to-date. So they keep track of everything for you including what Phase you’re in, so you don’t have to.

How Do I Pay For It?

You typically have several payment options to pay your PDP premium: it can be deducted from your Social Security income, deducted from your bank account, you can pay using a credit card, or can pay a direct bill every month. For the deductible, coinsurance, and copays, they are generally due at the counter if you pick up your meds at the pharmacy, or you’re billed if you use a mail-order pharmacy.

How Do I Sign Up?

You can sign up several ways including calling Medicare directly, calling the insurance company directly, enrolling through the Medicare.gov website’s Plan Finder, enrolling with the assistance of an independent insurance agent, etc. This is not a comprehensive list, but the important thing to remember is that the plan, its premium, and all of its cost shares and coverage is exactly the same no matter how you sign up. One of the main reasons to use an independent insurance agent that can represent many companies is that that agent can assist you considering your prescription needs and your budget and answer your questions so you can make an educated decision on which Part D plan is best for you.

When Will it Start?

Your plan can start as soon as either Part A or Part B are effective, and no sooner. The effective date of your plan will depend on the day you apply for it and the specific enrollment period you’re in. Click the link for more detail.

Do I Have to Sign Up?

Not necessarily. If you, or your spouse, are still working and you are covered by that employer’s group health plan, you don’t need to sign up for Medicare Part D as long as the prescription coverage in that plan is considered “creditable coverage”. If it’s not and you don’t sign up for a Part D plan when you’re first eligible for Medicare, you’ll likely have to pay a Late Enrollment Penalty (LEP) when you do sign up for Part D later.

The LEP is calculated by multiplying 1% of the “national base beneficiary premium” ($33.06 in 2021) by the number of months you didn’t have creditable coverage. You don’t have to pay this penalty until you actually sign up for a Part D plan, but you’ll owe this penalty every month as long as you have a plan. And even though the percentage stops increasing once you enroll in Part D, the national base beneficiary premium will likely continue to increase. This causes your LEP amount to increase over time as well. It’s often a good idea to enroll in a Part D plan once you’re first eligible even if you’re not taking any medications in order to avoid this lifelong penalty.