That is the question that has most of you stumped.

If you’ve figured out you need one of these types of Medicare plans, then you’ve already ruled out other options like:

- Coverage through your current employer

- Medicaid

- Veteran's Benefits like Tricare or coverage thru the VA

- Retiree coverage through your former employer

So, now you know you need Medicare and to get your own supplemental insurance, but which one? (you can only get one, not both)

Well, let’s take an in-depth look at the main differences between each of these types of coverage to see what’s going to fit your needs the best.

But let’s start with the basics of each type…

More...

Medicare Supplement (Medigap) Basics

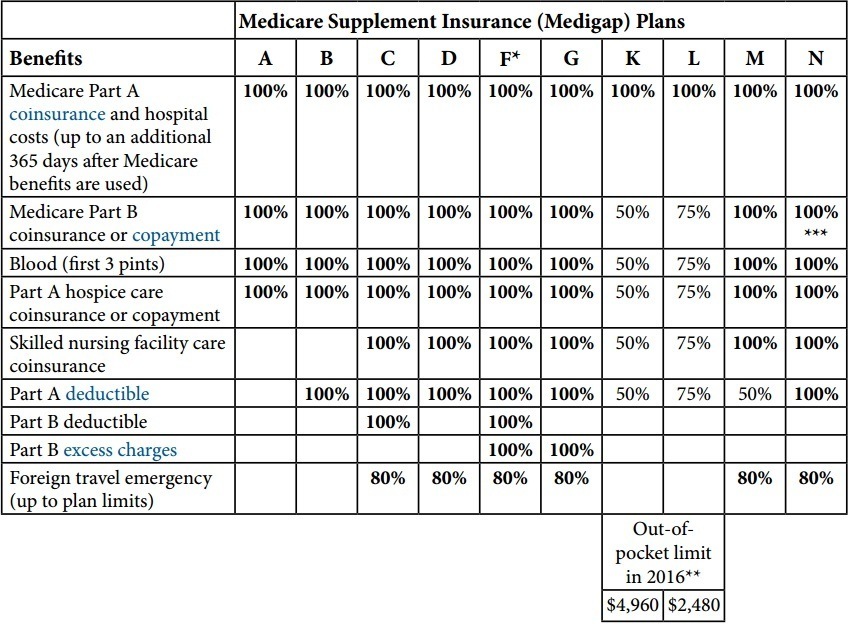

Medigap plans work together with Original Medicare Parts A & B. Part A and Part B have gaps in coverage where they don’t cover 100% of your healthcare expenses. Some of these gaps are the:

- Part A deductible

- Part B deductible

- Part B coinsurance

The various standardized Medigap plans will fill these gaps by paying the various deductibles, coinsurances, etc. for you. Each different type of plan will cover these gaps according to the chart below...

One thing worth noting is that Medigap plans do not cover prescription drugs. This is covered under Part D of Medicare. If you want a plan to cover prescriptions, you have to purchase an additional insurance policy to cover just these medications.

Now on to the other option:

Medicare Advantage (MA) Plan Basics

In order to enroll in an MA plan, you also have to be enrolled in both Part A and Part B. However, MA plans basically replace Original Medicare.

When you enroll in one of these plans, Medicare gives the MA insurance company you sign up with about $10,000 each year from your Medicare dollars. As a result, Medicare is no longer responsible for providing your healthcare; the MA insurance company is.

As a result, the MA plan sets the rules of your plan. They will decide things like:

- What your out-of-pocket expenses like deductibles, copays, and max out-of-pocket amounts for the year are

- What network of doctors, hospitals, and other healthcare providers you can use

- What types of additional benefits they’ll include like gym memberships and additional vision coverage

Most MA plans do include prescription coverage as part of the plan too. So, MA plans are a bit more of a comprehensive, all-in-one type of plan.

Now that you know the basics, let’s really dive in to see how these plans stack up in several different areas…

The 11 Main Differences Between Medigap and Medicare Advantage Plans

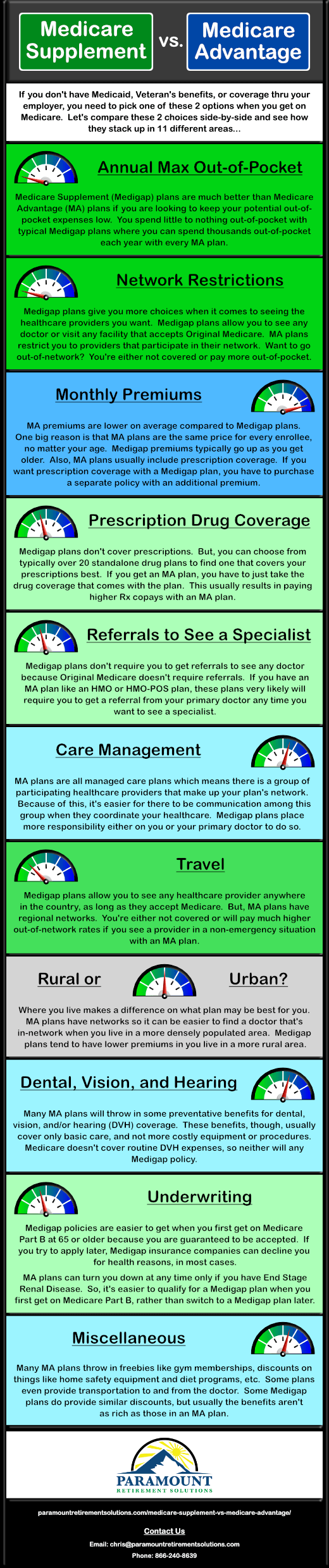

First, here is an infographic that summarizes all of the areas. Next, Scroll further down past the infographic to read about each area in more depth. (Click the infographic to download the PDF version.)

1. Annual Maximum Out-Of-Pocket (MOOP) Amounts

Medigap: Your MOOP amounts with Medigap plans are little to nothing.

Plan F is the most popular Medigap plan and it leaves you with ZERO out-of-pocket (OOP) to pay (as long as Medicare approves your test, treatment, etc.) Even Plan G limits your OOP to the Part B deductible, which is $183 for the entire year.

Some other plans like Plan N, K, or L do increase your potential MOOP to a few thousand dollars per year. In return though, these plans will lower your monthly premiums. However, one of the biggest reasons that most folks choose a Medigap plan is keeping potential OOP very low and predictable.

Medicare Advantage: Your MOOP with MA plans typically range anywhere from $3,000 - $10,000 for each calendar year.

MOOPs are lower for Health Maintenance Organizations (HMO), compared to those for Preferred Provider Organizations (PPO). Also, the higher your monthly premium is, the lower your potential MOOP typically is. Lastly, PPOs do allow you to use healthcare providers out-of-network, but then you’re subject to larger MOOP amounts compared to if you stayed strictly in-network.

The main point is this: even if you pick an HMO, stay in-network, and pay a large monthly plan premium, there is no avoiding large potential MOOP amounts with MA plans.

2. Network Restrictions

Medigap: Medigap plans have no network restrictions.

As long as the healthcare provider you want to see takes Medicare, they will take whatever Medigap plan you have, no matter what insurance company it’s thru. Medigap plans are standardized, which means they have to cover exactly the benefit amounts that Medicare determines according to the plan letter (Plan G, for example). The insurance companies doesn’t get to pick and choose what they cover.

Almost every doctor takes Medicare so this gives you a wide selection of choices when it comes to who provides your healthcare. This can be extremely important when you have to treat a chronic condition and want to see a specialist that may not accept Advantage plans.

Medicare Advantage: Every MA plan has a participating network of healthcare providers.

With pure HMOs, you are not covered at all if you get treated outside of the HMO network. PPOs do give you the freedom to see out-of-network providers, but (as was mentioned above) you’ll pay higher rates to do so. One exception to this rule is that if you have an emergency/urgent medical situation, you can get treated out-of-network and still pay in-network rates.

One other thing worth mentioning is that doctors can leave the network at any time. So, if you sign up for an MA plan that your doctor accepts, then he or she changes their mind about taking that plan, you have to wait until the next annual enrollment period to switch plans.

3. Monthly Premiums

Medigap: Medigap premiums are higher, on average, compared to MA plans.

They naturally cost more each month since Medigap plans lower potential OOP amounts and give you more choices on where you can use them. Also, any Medigap plan sold since 2006 does not cover prescription drugs (Part D). If you want to get Part D coverage, you have to purchase an additional stand-alone drug plan.

Medicare Advantage: Medicare Advantage premiums can have a wide range in your area. They’re priced depending on the county you live in. Most MA plans include drug coverage in the plan and have one combined premium for both the drug and health parts.

Another reason MA premiums are cheaper, on average, than Medigap premiums is because premiums are the same for every age. The older you get, the more you’ll probably use your plan, so your OOP expenses will increase, but not your premium. This is the opposite of Medigap plans: their premiums increase with age, but OOP amounts don’t.

4. Prescription Drug Coverage

Medigap: As mentioned above, Medigap policies sold today don’t include drug coverage.

You can choose any standalone prescription drug plan (PDP) available in your county; it does not have to be with the same insurance company that provides your Medigap coverage.

There are usually around 20-25 PDPs to choose from. The Medicare Plan Finder will find the PDP for you that gives you the lowest total yearly drug cost based on your the list of prescriptions you take. You input your meds into this tool, along with your zip code/county and preferred pharmacy, and this Plan Finder will find the most cost-efficient plan for you. It will total all drug costs for the year, including all monthly premiums and copays.

Medicare Advantage: Most MA plans do include drug coverage as part of the plan. Although this saves you money in monthly premium, it generally will cost you more in copays when you fill your prescriptions.

With Medigap plans, you can pick the best PDP among 20-25 different choices; with MA plans, you take the drug coverage that comes with the plan. You can get plans with better drug coverage, which will lower your drug copays. But, you have to pick plans with higher monthly premiums to do so.

So maybe you’re thinking: “well, I’ll just sign up for an MA plan without drug coverage and sign up for a PDP with low copays too”. Not so fast. Medicare doesn’t allow this. You can only be enrolled in any MA plan or a PDP. Enrolling in one will terminate the enrollment of the other.

5. Referrals to See a Specialist

Medigap: When you have a Medigap plan, you have Original Medicare as your primary insurance. Medicare does not require referrals to see any specialists, so neither does your Medigap plan.

Medicare Advantage: Some MA plans do require referrals:

- Private Fee-For-Service plans do not require referrals.

- PPO plans usually do not require referrals.

- However, HMO plans and HMO-POS plans usually do require referrals from your primary doctor if you want to see a specialist.

6. Care Management

Medigap: If you choose to get a Medigap plan, you’re depending on your doctors, mainly your primary doctor, to coordinate your care. You have more freedom who you can see, but you take a bit more responsibility in making sure all your doctors are on the same page.

Medicare Advantage: MA plans usually have some level of coordinating care. As mentioned above, HMO plans often require you to get referrals. Even though this can be a bit inconvenient, it allows your primary care physician (PCP) to coordinate your care a lot easier.

Any MA plan will have some level of coordinating your care since these plans are often referred to as “managed care plans”. When you stay in-network, you allow all your healthcare providers to work together better.

7. Travel

Medigap: With Medigap plans, Original Medicare is your primary insurance. Medicare is a national program so it should be just as easy finding a doctor that accepts your plan anywhere in the country as it is for you at home. This can allow you the freedom to travel within the country and not be limited by choosing the healthcare provider you wish.

Medicare Advantage: If you travel a lot, having a MA plan will be more restrictive. HMOs very rarely will cover you beyond your home network; PPOs cover you out-of-network, but at a much higher cost-sharing amount (the exception being emergency care, as mentioned in the ‘Network Restrictions’ section above).

8. Rural vs. Urban

Medigap: The further you get away from densely populated areas, the more limited you are with the number of doctors and hospitals to choose from. If you have a Medigap policy, this will allow you to see any doctor who accepts Medicare. This makes it more likely you can find someone who meets your healthcare needs closer to home.

Also, the cost of healthcare is less expensive in more rural areas with smaller populations. Medigap companies set their rates based on the amount of healthcare claims they have to pay. So naturally, Medigap premiums can be quite a bit less expensive away from major metro areas.

Medicare Advantage: Because MA plans all have networks, it can be challenging to find someone who accepts your insurance if you live far away from a big city. These plans are more competitive in urban areas because their networks give you more options without driving too far.

9. Dental, Vision, & Hearing Coverage

Medigap: Unfortunately, decent coverage for dental, vision, and/or hearing is sorely lacking once you get on Medicare.

Original Medicare does not consider any routine dental, vision, or hearing to be “medically necessary”. Therefore, they won’t cover it. This means Medigap plans won’t cover it either.

Keep in mind though, that if you need anything related to these areas like cataract surgery, treatment for glaucoma, or any other “medically necessary” procedure, test, etc., Medicare + Medigap will cover you.

Medicare Advantage: MA plans do often throw in some level of preventative coverage in these areas.

This means that many plans will cover a routine eye exam free once per year. A lot of plans will pay for up to two cleanings and oral exams per year, and maybe a set of xrays of your mouth every two years. However, if you need something beyond preventative done (you need a root canal and a crown, for example), you’re on your own to pay full price out-of-pocket.

You have to figure out how much the dollar value these types of benefits offer are worth to you. How much will teeth cleanings, oral exams, free eye checkups, etc. save you? Many dentists will offer reduced rates if you don’t have dental insurance. You can weigh these savings against the other out-of-pocket expenses you have with MA plans mentioned above.

10. Underwriting

Medigap: This concept requires you to look a little bit more at the big picture. When you get on Medicare for the first time, you can get any Medigap plan you want with no questions asked. Why? Because you’re in your Medigap Open Enrollment Period.

Once this 6-month period is done, you have to answer health questions and be approved (underwriting) if you want to get a Medigap plan. So Medigap policies are much easier to get when you first get on Medicare, than down the road.

Medicare Advantage: The only way you can get turned down when you apply for an MA plan is if you have End Stage Renal Disease (ESRD). This is basically kidney failure and you need dialysis or a kidney transplant.

Some of you may decide to get an MA plan when you first get on Medicare because you’re pretty healthy and you want to save money in monthly premiums. You may be thinking “well, I’ll just get more comprehensive insurance like a Medigap plan when I’m doctoring for more as I get older”. But, do you see the danger in that thinking? By the time you want better coverage, like a Medigap plan, you might not be healthy enough to qualify for it.

11. Miscellaneous

Medigap: Medigap plans focus on giving you coverage to pay for the bulk of your healthcare expenses.

Now some plans will throw in extras like prescription discount cards (not prescription insurance) or discounts on programs like Weight Watchers. But for the most part, they focus on covering your healthcare.

Medicare Advantage: MA plans do seem to offer these extras a bit more.

Many MA plans offer free, or discounted, gym memberships at participating gyms. Some plans cover transportation to and from the doctor, if you qualify. Other plans will give you a fixed amount per year to spend on things like shower grab-bars and other home safety equipment.

Conclusion

As you can see by the comparison above, Medigap and MA plans are quite a bit different. Choosing between the two will depend a lot on your current health and monthly budget. Plan prices and choices differ greatly depending on the region where you live. Also, you really have to look at not only your current situation, but also anticipate your health needs years from now as you get older.

If you try to figure this all out on your own, you’re really doing yourself a disservice. It really is best to discuss your options with a professional who can answer your questions and give you quotes for the plans you’re interested in.

If you’re interested, I’m an independent insurance agent who works with lots of different insurance companies offering these types of plans. I’d love to help you out with any questions you might have, or to help you sign up once you decide on the plan you want. You can call me at 866-240-8639.