Medigap Plans

So this is the chapter that a lot of you probably skipped ahead to, right?

You already know you need Medicare and are just looking to figure out which Medigap plan to get. Or maybe you’re looking to see what Medigap plans offer and compare it to your work insurance to see which is going to be the best way for you to go.

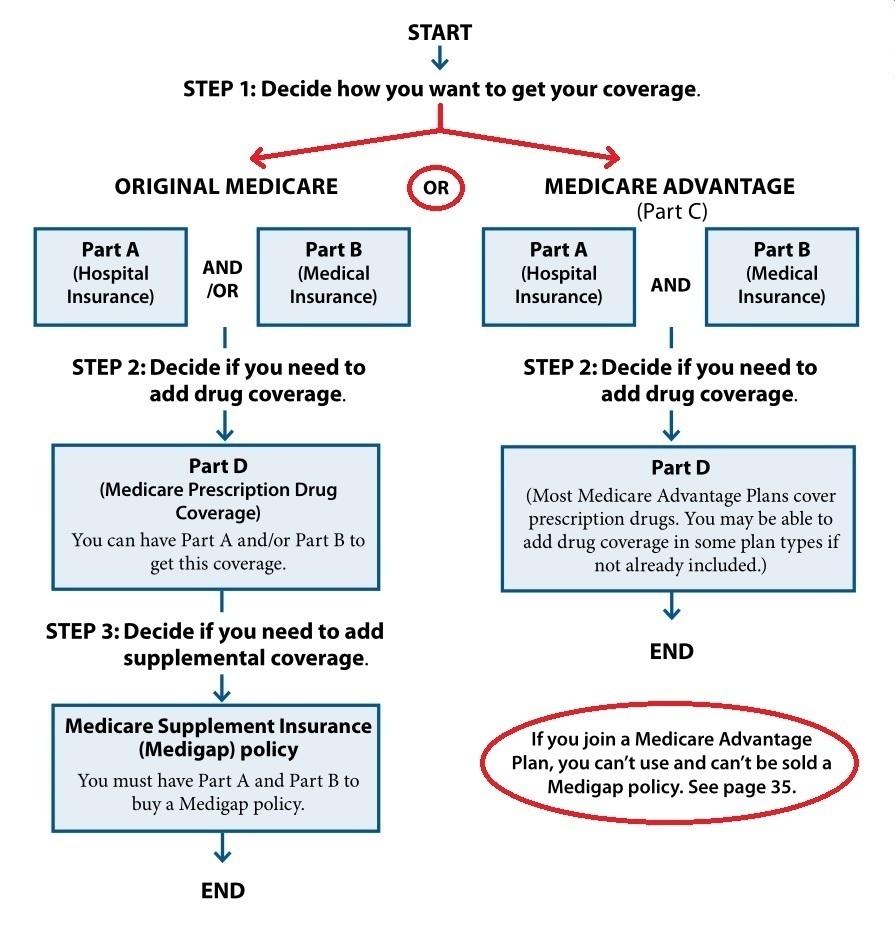

There are only two types of secondary insurance to Original Medicare, and they’re actually quite different. Medicare Advantage plans are the other type and we’ll be discussing those in Chapter 6. Take a look at the chart below to see how you can only pick one type or the other, not both.

Let’s start the discussion with what exactly Medigap plans are, and really why they’re different than pretty much any insurance plan you’ve ever had before…

Medigap Plans Defined

Medigap plans are supplemental health plans that are paired with Original Medicare (Parts A & B) to provide complete healthcare coverage for medical and inpatient expenses.

Ok, so the first thing to understand is that Medigap plans are nothing on their own. They work with Parts A & B. They fill in the gaps of A & B. That’s why Medigap is the perfect name for them. They fill in the Medicare gaps.

So what Medicare gaps, you say? These are the Part A & B deductibles we went over in detail in Chapter 1.

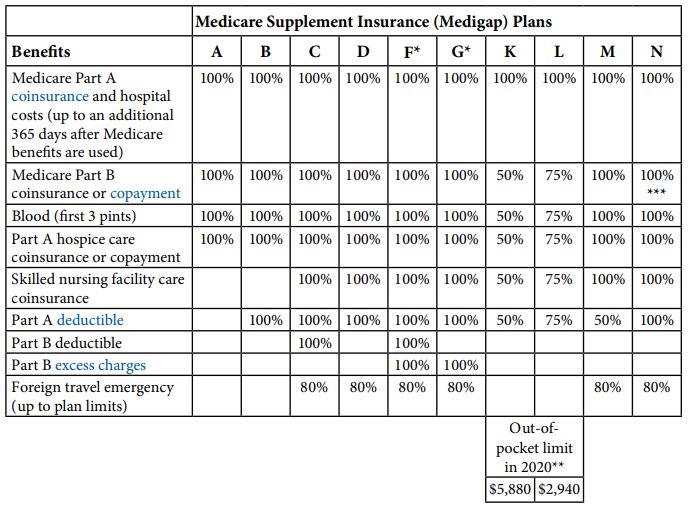

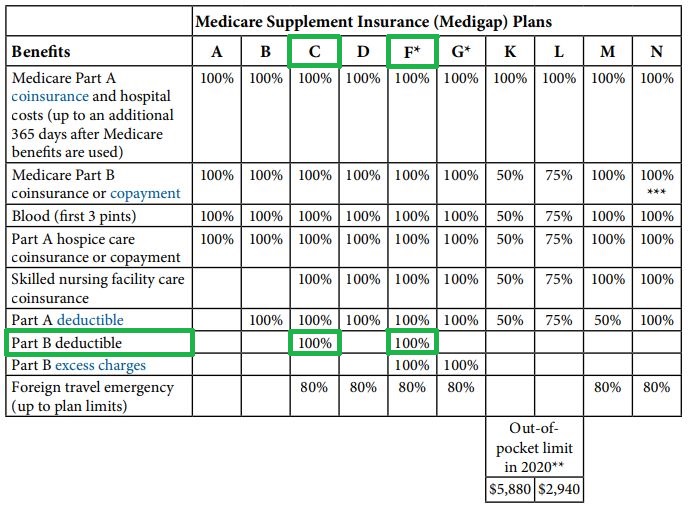

There are eleven Medigap plans available, each with represented by a different letter. You can see them in the chart below:

So you can see each letter plan is a bit different. The different letter plans (for example, Plan G) are listed along the top. Most of the different gaps we talked about in Chapter 1 are listed on the left under "Benefits".

Each plan will pay for 100%, a portion, or none of each of these out-of-pocket expenses. And because some plans cover more than others, some letter Medigap plans will have higher premiums than others. We'll go over four of the plans in detail later in this chapter.

Another thing to understand about these plans is that you don’t see any insurance company names on the chart, right? Medigap plans are offered by insurance companies, so why aren’t they mentioned?

This is because Medigap plans are standardized. This just means the same letter plans have exactly the same coverage from one insurance company to another. So for example, Plan N with Company ABC is the same coverage as Plan N with Company XYZ. Their coverage simply has to follow the chart above. The only difference from one company to the next is the premium they charge.

One last thing to mention is that with any Medigap plan, Medicare is your primary insurance. This means that if any healthcare provider accepts Medicare they have to accept any of the Medigap plans shown above no matter what insurance company provides it. That’s very different than your current plan where you have to make sure your doctor takes your insurance.

Before we take a look at some of the individual plans, we really need to understand why turning 65 is such an important time when it comes to Medigap plans…

Medigap Open Enrollment (OE) Period

Your Medigap OE period is the *one time in your life you can get any Medigap plan you want to with no health questions.

*Ok, technically some states do have an additional OE period if you qualify for Medicare younger than 65. And, you do have a Guaranteed Issue period up until you turn 66 where you can get any Medigap plan you want if you started Part A at 65 and initially chose to get on a Medicare Advantage plan.

But, in most cases, any time you want to get a Medigap plan later, you’ll have to qualify.

This OE period starts when both of the following conditions are true:

- You’re on Part B

- You’re 65 or older

So, if you’re turning 65 and already have been on Medicare, now is a great chance to get a Medigap plan. When you’re younger than 65, your Medigap plan options are either limited, not available at all, and/or incredibly expensive.

Something else to consider is the words “or older” in that second condition above. This is why being able to defer Part B at 65 if you’re still covered by an employer group health plan (EGHP) like we discussed in Chapter 2 is such a big deal. You could stay on your EGHP for many more years past 65, sign up for Part B when this plan is no longer an option (like when you retire), and save your Medigap OE period for when you’re ready.

Now, let’s look a few of the most popular Medigap plans in a bit more detail…

Medigap Plan F

In 2010 the Medigap chart was changed to what we saw above. Some plans were added, and some were taken away. In 2020 it changed again.

What Plan F Covers

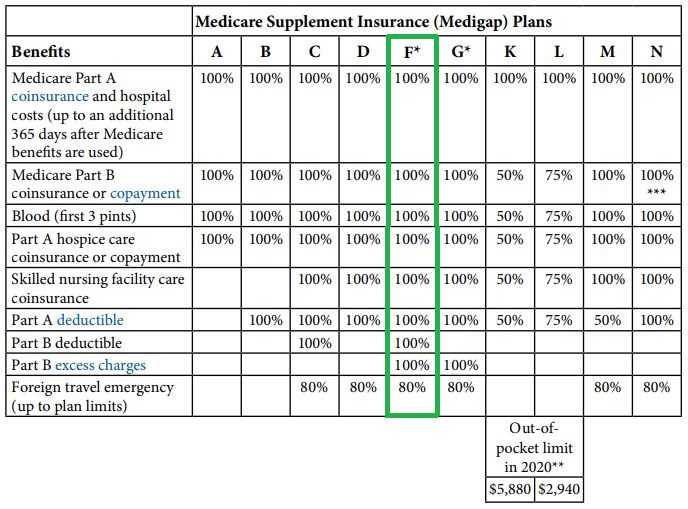

Let's look at that chart below. You can see Plan F down the middle of the page. There is 100% coverage for everything except foreign travel emergencies. If it has 100% in the box for a particular Medicare gap listed in the left column, it will pay 100% of that Part A and Part B deductible or coinsurance.

Plan F has “first dollar coverage”

If we take a look at the Medigap chart again we see that only two plans cover the Part B deductible. Plan F is one of them.

This is convenient for anyone that has Plan F because they know they that they won’t have to pay a bill or copay for things like doctor’s visits, urgent care visits, and basic tests. As long as Medicare approves it, Plan F will pick up the rest.

But that makes folks that have Plan F much more likely to run to the doctor or urgent care for every little thing.

Had a sore throat for a few days? Might as well go to urgent care for an antibiotic prescription.

Is that rash on your foot itchier than normal this week? Time to see a dermatologist again.

Now I’m not saying it’s wrong to see these healthcare providers when you have these medical issues. What I’m saying is that folks that have Plan F are much more likely to use their insurance for these likely non-emergency situations than someone else who has a different Medigap plan with even a small deductible. If you know it might cost you $125 for that urgent care visit, you might be willing to wait a few days for your cold to go away on its own.

So, this results in higher claims that insurance companies have to pay for Plan F subscribers. And this makes Plan F rates higher than other plans.

Why?

Medigap plans decide their rates based on how much they have to pay out in medical claims. Higher claims = higher rates.

Plan F is no longer available to anyone first eligible for Medicare in 2020 and later

Remember when I said earlier that the Medigap chart will look different in 2020? Well, that’s because the “first dollar coverage” plans, Plan F and Plan C, have gone away for folks new to Medicare.

Anyone who has a Part B effective date of January 1, 2020 or later will no longer be able to get Plan F. But if your Part B date is before this, you will be able to keep it after 2020 and you could even sign up for a new Plan F after then if you wish.

So how does this affect you if your Part B date is before 2020?

If a Medigap plan stops taking new members, then they stop taking the folks new to Medicare at 65. This group usually has the best health of folks on Medicare. As a result, the average amount of claims per person will be higher with Plan F.

Then, things start to snowball. Like we mentioned earlier, (for the most part) the only time you can sign up for a Medigap plan with no health questions is in your Medigap OE period. So for the folks that have Plan F that are looking to switch plans to save money, the only ones that are going to be able to do so are the healthy ones.

This will cause the less healthy ones to be stuck, file more claims, drive up premiums, and now you’ve got this vicious spiral. Take a look at the picture below for a better illustration:

Pool A - Big pool of people, lots of new healthy people joining all the time

Pool B - Pool is closed, average person's health is getting worse, and premiums start to increase

Pool C - Healthy people start to leave the closed pool, the amount of health claims and premiums keep going up

Pool D - Almost all healthy people have left, the remaining folks are stuck, and premiums have increased dramatically

Because of all this, you’re better off getting a different plan anyway. Here are some of your other options…

Medigap Plan G

So why is Plan G so much better of a deal than Plan F was anyway?

Well for starters, Plan G is simply more cost-efficient...

What Plan G Does and Doesn’t Cover

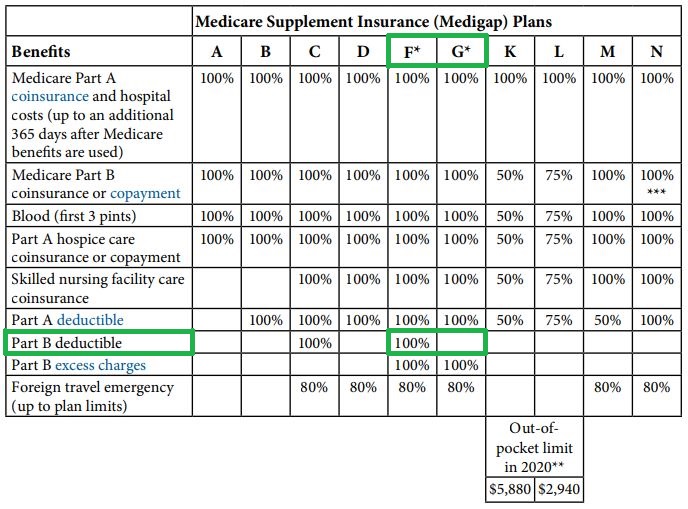

The only difference between Plans F and G is the coverage of the $203 Part B deductible. You can see that in the chart below:

This means Plan G pays for all of your medically necessary Part A expenses. And, it pays for your Part B expenses after you meet the Part B deductible.

Why Plan G is Better Than F Was

So, even if you had to pay the full Part B deductible for the year, that works out to about $15 per month ($203/12 = $16.92). At age 65 the best Plan F rates available were usually $20 - $30 more expensive than the best Plan G rate.

Also, Plan G is not a "first dollar coverage" plan. This means that Plan G won't increase over time as fast as Plan F did.

But, when Plan F went away for folks new to Medicare in 2020, Plan G changed and has gotten more expensive as a result...

Why Plan G Will Get Expensive More Quickly

Remember before we talked about how Medigap plans base their rates on how much they have to pay out in medical claims?

Plan G tends to have people whose health isn’t quite as good as people with some other letter plans. But why is that?

Well one of the reasons is for this thing called Guaranteed Issue (GI). GI allows people who have lost their healthcare coverage for different reasons to get Plan G guaranteed, with no health questions. They’re automatically accepted. Here are some of those reasons someone could’ve lost coverage:

- Your current Medigap company goes bankrupt and you lose coverage

- Your current Medigap coverage ends through no fault of your own

- Your current Medicare secondary insurance (Medigap or Advantage plan) misled you or didn’t follow the rules

- You dropped a Medigap policy to get a Medicare Advantage plan for the first time and you want to switch back within 12 months

- Your current Medicare Advantage plan is either leaving Medicare, stops giving care in your area, or you move out of the plan’s area of coverage

- Your current employer group health plan that is secondary to Original Medicare is ending

So if someone eligible for Medicare on or after January 1, 2020 had one of these qualifying reasons, they can get any company’s Plan G they wish, no matter what their health is.

You can see the six GI plans in the chart below:

insert chart

Because they can get Plan G with no health questions in these GI situations, this results in higher claims and higher rates with Plan G compared to other plans that are not GI.

This was a new change to Plan G that started in 2020, and we started to see rates increase for Plan G as early as late 2018 as insurance companies "priced in" this change.

Mainly because of this, my new favorite Medigap plan is:

Medigap Plan N

Plan N is actually the newest Medigap plan. And, it's not Guaranteed issue.

When they “modernized” the Medigap plans in 2010, they created Plan N as a nice way to keep OOP low if folks don’t mind having to pay a copay here and there.

There is one area of coverage though that you have to be a bit careful of with Plan N, and we’ll get to that as we talk about what it does and doesn’t cover.

What Plan N Does and Doesn’t Cover

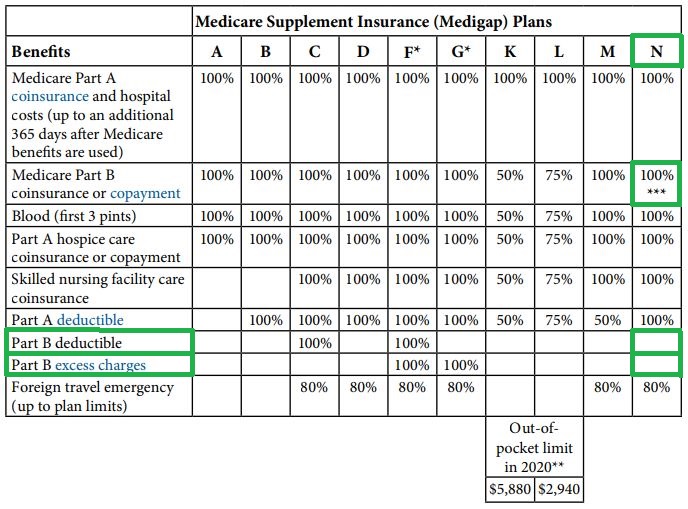

Once again, let’s go back to the chart...

We can see that Plan N covers all but 3 things:

- The Part B deductible

- Part B copays for office visits and emergency room (ER) visits

- Part B excess charges

We’ve already talked about the Part B deductible gap with Plan G, so Plan N would work the same where you’d have to pay the first $203 for the year.

After that, you will pay a maximum of $20 to have an office visit with a doctor. This could be with your primary doctor or with a specialist, it doesn’t matter. However, if it’s a visit with your primary doctor, you could end up spending less than $20 for that visit.

You would also owe a maximum of $50 if you go to the ER. But, if you are admitted to the hospital if you go, this copay would be waived.

So, if you slice your finger in the kitchen after urgent care has already closed and you need stitches, you’d have a $50 ER copay max. But, if you’re having chest pains and they find you’re having a heart attack and want to admit you, your copay would be waived.

What to Be Careful of With Plan N

The last gap in Plan N coverage is what are known as Part B excess charges.

Most healthcare providers accept Medicare. When they do, they agree to accept Medicare-approved payment amounts for their services. This is called “assignment”.

Not every provider accepts assignment though. In some rare cases, healthcare providers can charge an additional charge above and beyond the Medicare-approved amount for a Part B service. This is called an excess charge.

How much is it you ask? Well, the way it’s calculated is that it’s 15% more than 95% of the full assignment amount. Let’s clear this up with an example:

Let’s say you visit an oncologist for a certain type of cancer treatment. The Medicare approved amount for this procedure is $3,000. This doctor charges excess charges for this treatment.

The excess charge amount would be: $3,000 x 95% = $2,850. Then, multiply $2,850 by 15% = $427.50.

In this example, this non-participating provider could charge you an extra $427.50. Plans F and G would cover this charge and pay for it. But if you had Plan N, you’d have to pay for it yourself.

These situations with excess charges don’t come up all that often. In some states, doctors are not actually allowed to charge them. But, things may change in the future, and more doctors could become non-participating.

In the cases these charges arise, your potential out-of-pocket costs technically are unlimited since you could owe this excess charge for each and every service. It’s just something to consider as you decide which Medigap plan is best for you.

Medigap High-Deductible Plan G

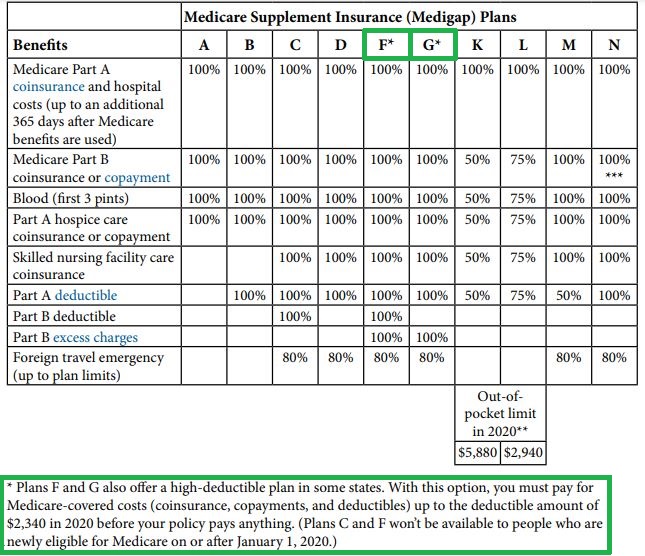

If you take a look at the Medigap plan chart again, you’ll notice a little asterisk by Plan G. That’s because there is a high-deductible Plan G (HD-G) that’s completely different than Plan F we mentioned earlier.

Also, look at the description of Plan HD-G under the chart:

What Plan HD-G Does and Doesn’t Cover

The thing that makes this plan different is that the Medigap insurance company doesn’t pay anything for that year until you pay the full deductible. The deductible for 2021 is $2,370. If you notice the chart above is from 2021 and it shows a different deductible, so this deductible does tend to increase a bit from year to year.

Keep in mind, Medicare still pays their part up until the point you pay the deductible. So, for example, you still owe the Part A deductible, Part B deductible, Part B coinsurance, etc. while Medicare pays their part. Let’s look at a couple examples:

- You are admitted to the hospital and need a knee replacement surgery. You have to pay the $1,484 Part A deductible while Medicare pays the rest of your Part A expenses during your first 60 days of your stay.

Since your orthopedic doctor is performing the surgery, let’s say he bills another $2,000 in Part B services. You’d have to pay the Part B deductible of $203, and then 20% of the rest of the Part B charges. That amount is 20% x ($2,000 - $203) = $359.40.

So, your total OOP costs in this example are: $1,484 + $203 + $359.40 = $2,046.40. Since you have another $323.60 ($2,370 - $2,046.40 = $323.60) left in meeting your deductible, you could pay up to this amount as you need physical therapy to rehab your knee after your surgery. - You are diagnosed with cancer and need six rounds of chemo spaced one month apart. Each round of chemo costs $1,500. You’re not hospitalized and everything is outpatient.

For the first round, you’d pay the first $203, then you would owe 20% of the rest which I is $259.40 (20% x ($1500 - $203) = $259.40). Your total for the first round is $462.40.

For every round after this the rest of the year, you’d owe $300 (20% x $1,500 = $300). So your total for the six rounds is $1,962.40 ($462.40 + $300 + $300 + $300 + $300 + $300 = $1,962.40).

Where Plan HD-G Might Make Sense

So, in the above examples, they’re showing you when Plan HD-G could get expensive. But obviously most of you won’t have these types of expenses, at least every year anyway.

Plan HD-G usually has a monthly premium of a little less than half of that of Plan G. You’re taking on more risk every year, so the plan has to cost less each month since it doesn’t cover as much.

If you’re in pretty good health, don’t mind the potential of paying a some larger OOP expenses once in a while, and still want to be able to see any doctor who accepts Medicare, then Plan HD-G may make sense for you. And, since the annual deductible is the maximum amount you’d pay for Part A & B expenses, you at least have a fixed downside in case you have a bad health year.

Medigap Prescription Drug Coverage

You may have noticed that none of the plans I discussed above cover prescriptions. They only supplement Parts A & B of Medicare, not Part D. In the past Medigap plans did cover prescriptions too, but not since 2006.

If you want a Medigap Plan and drug coverage, you’ll need a standalone prescription plan, which just so happens to be the topic in the next chapter.