Medicare Part A: Hospital Insurance

Hospital stays can be crazy expensive, right?

I’m sure many of you know of someone that had a 5 or 6-figure bill from the hospital, at least before insurance paid their part.

Fortunately, Medicare Part A will pay for a good portion of these inpatient costs. But there are some pretty big gaps that are still left.

Let’s take a look at exactly what Medicare Part A is, what’s covered, what your costs are, and how you can protect yourself from big bills down the road…

Medicare Part A: What Exactly is it?

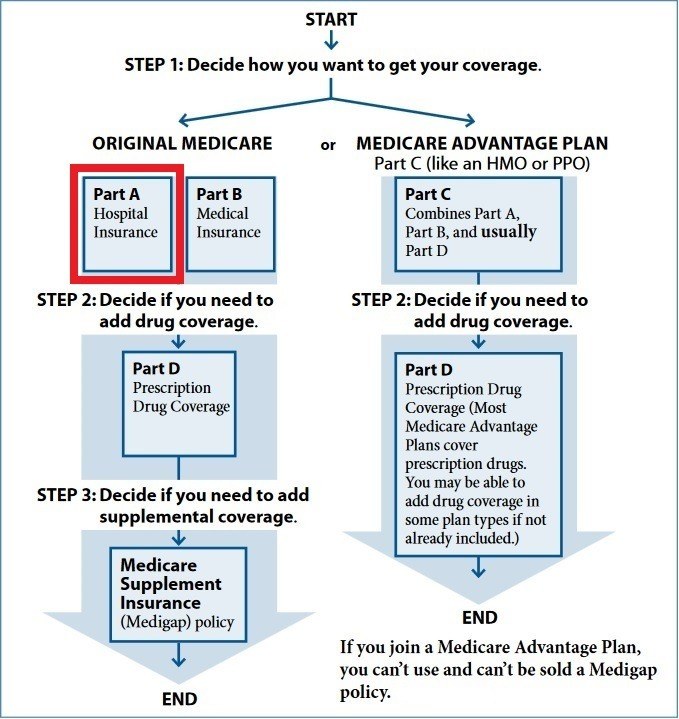

Medicare Part A, also known as Hospital Insurance, is one of the 4 main parts of Medicare. The other 3 are:

You can see where Part A fits in to the overall picture of Medicare in the picture below:

Part A and Part B together are known as Original Medicare. They are the only 2 parts of Medicare provided directly by the Federal government.

You can see these two Parts are shown on your Medicare card, along with the dates they started.

Medicare Part A: How Can I Get it?

You can get Part A if you qualify for Original Medicare. This means you must be either:

- 65 or older

- Younger than 65 and have been eligible for receiving Social Security disability benefits, or certain Railroad Retirement Board benefits, for 24 months or more

- Any age and have certain health conditions like Amyotrophic Lateral Sclerosis (ALS) or End Stage Renal Disease (ESRD)

Of course you have to be a U.S. citizen, or permanent legal resident.

These are the different ways you can sign up for it (in order of most to least convenient):

Sign-up Method #1: You’re Automatically Enrolled

Turning 65

If you’re receiving any type of Social Security income at least 4 months before you turn 65, you’ll automatically be signed up for Medicare Part A (and Part B) at age 65.

Your Part A start date will show on your Medicare card as the 1st day of the month you turn 65. If your birthday happens to be on the first of the month, your start date will actually be a full month before that.

For example: if you were born on October 1, 1956, your default Part A start date would be September 1, 2021.

You’ll get your Medicare card in the mail about 3 to 3.5 months before your start date. It should come in a white envelope that shows “Department of Health & Human Services” as the sender in the upper left-hand corner.

You’re going to be getting a ton of mail at this time, (link to mail blog post) so make sure to keep an eye out for this envelope and don’t throw it out by mistake!

Getting Disability Payments

Part A will start for you the first day of your 25th month of disability.

Just like turning 65, your card will come in the mail 3 to 3.5 months in advance.

However, if you have ALS, your Medicare coverage will start your first month of disability.

Sign-up Method #2: Enroll Online

If you’re not yet drawing Social Security, signing up for Part A online is the quickest and easiest way to do so.

You’ll need to have a “my Social Security” account. If you don’t have one yet, you can sign up for one at https://www.ssa.gov/myaccount/

When you have that account active, you can sign up for either Part A only, or Parts A and B together. You can sign up for Part A without Part B in certain situations where you still have a health plan through a job that either you or your spouse currently work at.

If you don’t finish your online application in one sitting, you’ll get a re-entry number. This number is usually 8-digits.

Be careful, this number will be the same number that you get when you successfully finish the application. So, make sure it tells you your number is your confirmation number to show you that your application is done and submitted.

Keep in mind, you can only use this method if you’re starting Part A for the first time in your Initial Enrollment Period (IEP) at age 65. Your IEP starts 3 months before your Part A start date and lasts for 7 months. If you’re signing up for Part A later on because you’ve been covered by an employer group health plan, you’ll have to use method #3 or #4 below.

Sign-up Method #3: Over the Phone

Maybe you’re not completely comfortable using the computer.

Or you possibly don’t trust putting in your personal information online.

The “my Social Security” website might not be letting you open an account.

Whatever the reason you don’t or can’t sign up online, you can always give Social Security a call at 800-772-1213 to get the sign-up process started.

I say “started” because you usually can’t complete the sign-up process over the phone. The Social Security agent you speak with will typically mail you the forms you need to fill out.

This requires waiting for the forms to arrive, filling them out, and mailing them back. So keep in mind, this process takes longer than signing up online. There can be mail delays, forms could get lost in the mail, you might fill something out incorrectly, etc.

Don’t use this method if you’re already cutting it close to your start date.

Also, when you call Social Security, someone isn’t always available right then to help you and will schedule an appointment at a later date.

Sign-up Method #4: In Person

If you’d like to sit down with a “real” person face-to-face to sign up for Part A, just visit your local Social Security office to do so.

You can just show up, or you can make an appointment. Social Security does not have an online scheduler, so just call your local office to set it up.

If you’re not sure where the most convenient office is, just use https://www.ssa.gov/locator/

Keep in mind, in March of 2020 all offices stopped service the public face-to-face because of COVID. So, it’s a good idea to give your local office a call before going just to make sure they’re available to help you.

Now that we know how we can get it, let’s look at…

Medicare Part A: What Does it Cover?

If you have Medicare, Part A will cover you when one of two things happens:

- You’re admitted to a hospital as an inpatient, or

- You qualify for hospice care

Let’s take a look at the different types of places you can be covered as an inpatient…

Hospital

There are several different types of hospitals covered by Part A. Here are the most common:

- Acute Care Hospitals – the most common type of hospital stay, general short-term

- Critical Access Hospitals – a small hospital available in rural areas with less than 25 beds

- Long-Term Care Hospitals – acute care hospitals with longer stays, averaging 25 days

- Inpatient Rehab Facilities – specialize in medical conditions that require intense rehab

- Psychiatric Hospitals – specialize in treating mental health conditions

Part A will cover things like your semi-private room, meals, nursing services, and other services and supplies at part of being treated as an inpatient.

Skilled Nursing Facility (SNF)

Once you’re released from the hospital, your health care staff might recommend that you be admitted to a SNF instead of going straight home. This gives you an opportunity to recover a bit more and be supervised by medical staff anytime around the clock if you need it.

SNFs can also be called a post-hospital stay, or rehab. However, they won’t require near as much or as intensive rehab as you’d get in an inpatient rehab facility.

Also, SNFs are a medical facility. You need to be there for a medical reason that requires medical care and/or supervision.

They’re different from nursing homes. Nursing homes provide custodial care, which is not medically necessary care. Custodial care is help getting dressed, using the bathroom, eating, etc.

Custodial care is not covered by Part A.

Home Health Care

Home health care can be covered under Part A or Part B.

To be covered under Part A, it must be provided both:

- Following a minimum of a 3-day inpatient hospital stay, and

- Within 14 days after being released either from the hospital or the SNF

Part A will cover up to 100 visits of home health care for a particular “spell of illness”. After 100 visits, Part B will cover this care. Also, if someone only has Part A and not Part B, the 100-visit restriction is waived and Part A will cover the care.

However, you still need to qualify to receive home health care, even after an inpatient stay. You must be:

- Under the care of a doctor who creates and regularly reviews your plan of care

- Needing some type of physical, occupational, or speech therapy or part-time skilled nursing care

- “Homebound”, where it’s very difficult to leave your home or not recommended because of your health condition

Hospice

Hospice is only thing covered under Part A that doesn’t require you to be admitted anywhere first.

Hospice is care for people who have a life expectancy of 6 months or less. It can be for any number of different disease or illnesses.

In order to qualify, a hospice doctor (and possibly your primary doctor too) agrees that you have 6 months or less to live.

Your hospice care is focused on making you as comfortable as possible, and not on curing your illness. So hospice will cover things like:

- Drugs to help manage pain

- Medical and nursing services

- Medical equipment and supplies to help manage symptoms

- Homemaker services

- Respite care, which can help relieve your friend or family member who mainly cares for you

You get hospice 90 days at a time to start. At the start of each 90 day period, your hospice doctor determines if you still have less than 6 months to live.

If you still need hospice after 6 months, you need to get approved for it every 60 days.

Also, you have the right to stop hospice whenever you wish. So, if your health is improving or if your disease goes into remission, you may leave at any time.

Now that we know all the things Part A covers, let’s look at what we should expect it to cost…

Medicare Part A Costs: Premium, Deductible, & Copays

We’ve got some good news and bad news here, and then some good news again.

First, the good news:

Part A Premium

Premium-Free

Only about 1% of people eligible for Medicare pay a monthly premium for Part A. Everyone else pays $0.

Why?

Because as long as you worked for 10 years (or 40 quarters) where you paid a FICA (Federal Insurance Contributions Act) tax out of your paycheck at work, you qualify for “premium-free” Part A. This entitles you to get Social Security Income benefits as well.

If you don’t have 40 quarters of work history where you paid FICA, you can still get premium-free Part A if:

- You’re married your current spouse for at least 12 months, they’re 62 or older, and they’re eligible to receive Social Security Benefits, or

- You’re single, but divorced, were married to your ex for at least 10 years, they’re 62 or older, and they’re eligible to receive Social Security Benefits, or

- You’re single, but widowed, were married to your late spouse for at least 9 months, and they were eligible to receive Social Security benefits when they passed away

- You’re under 65 and qualify for Social Security Disability benefits because of certain health conditions

Not Premium-Free

These situations cover almost all of the ways you can get premium-free Part A. Of course like anything with Medicare, there are rare exceptions, so you may still pay $0.

Otherwise, you will have to pay a monthly premium for Part A. There are two different amounts you could pay:

- If you have between 30 – 39 quarters of work history, you’ll pay $259 per month for Part A

- If you have less than 30 of work history, you’ll pay $471 per month for Part A

These amounts would apply to your current, ex, or late spouse too as it applies to you. This means you can get your premium reduced if they have over 30 quarters but you don’t.

For example: if you’re turning 65, only have a couple years of work history and your ex has 33 quarters, then you can get the reduced amount of $259 per month instead of having to pay the full $471.

Ways to Lower Your Premium Further

If you, your spouse, or you ex continues to work, your Part A premium can be reduced as you, or they, hit those 30 or 40 quarter marks.

For example: if you only have 28 quarters and are still working and owe a $471 premium now, you can get this down to $259 in 6 months or so with 2 more quarters of work.

And, you only have to earn $1,470 per quarter for it to count.

Another way to lower your premium is if you are eligible for Medicare at 65 and don’t qualify for premium-free Part A on your record, but your spouse is more than 3 years younger and has more work credits. Remember, they have to be at least 62 for you to get Medicare benefits based on their work record.

For example: if you only worked for 20 quarters, aren’t currently working, but your spouse is 60 and has over 40 quarters of work history. You have to pay the full Part A premium until they’re 62, then your premium would be $0.

Part A Deductibles

There are 2 deductibles for Part A…

The first deductible is a blood deductible. Yes, you read that right.

If you’re admitted to the hospital, you’re responsible for the cost of the first 3 pints of blood each calendar year that you need as a transfusion. The exception is if the hospital can get this blood from a blood bank or if it’s donated, you owe nothing.

The second deductible is due as soon as you get admitted to the hospital. You owe this Part A Deductible of $1,484 right away.

This deductible only covers you for a 60-day period called a benefit period. Your benefit period is over when you’ve gone 60 days in a row without inpatient care, including care in a skilled nursing facility too.

Once your benefit period is over, if you go back into the hospital then you’ll have to pay another deductible. It doesn’t matter if you get admitted for the same or a different illness, you’ll still have to pay again.

Another thing about the 60-day benefit period is that if you’re in the hospital for more than 60 total days in any benefit period, you’ll have to pay additional…

Part A Copays

For every day over 60 days in the hospital in any benefit period, you’ll pay:

- $371 per day for days 61 – 90. This amount is 1/4th of the Part A deductible.

- $742 per day after day 90, which is 1/2th of the Part A deductible. These are called “lifetime reserve days” and you only get a total of 60 of them in your lifetime.

There are also copays for a skilled nursing facility (SNF).

Now by paying your Part A deductible, this entitles you to the first 20 days in a SNF with no copays. But there is a catch. In order to qualify, you must:

- Have a minimum of a 3-day stay in the hospital, and

- Be admitted to the SNF within 30 days of being released from the hospital

If you’re in a SNF more than 20 days in any benefit period, you’ll have to pay daily copays just like in the hospital. SNF copays are $185.50 per day for days 21 – 100, which is 1/8th of the Part A deductible. After day 100, you have no more coverage.

Since a benefit period doesn’t end until you’ve been released from inpatient care for 60 days in a row, one benefit period can actually last several months.

It’s possible you could go from a hospital to a skilled nursing facility to home back into the hospital, for example. And as long as your benefit period hasn’t ended, any day that you’re in the hospital or SNF gets counted towards your total and subject to any of the copays we just went over.

Let’s look at some…

Part A Costs – Examples

#1 – You’re admitted to the hospital on March 7th and are there until April 11th. From there you go into a SNF on April 11th and stay until May 29th. You go home until June 8th when you go back into the hospital for another 21 days.

In this example, you had 34 days in the hospital the first time and 21 days the second time. Since you hadn’t gone more than 60 days in a row without being either in the hospital or SNF, it’s still under one benefit period. You spent a total of 55 days in the hospital, so you only owe the $1,484 deductible for those. You spent 48 days in a SNF, so you owe a copay of $185.50 per day for days 21 – 48.

#2 – You’re admitted to the hospital on September 19th and are there until September 24th. From there you go into a SNF on September 24th and stay until October 3rd. You go home until October 8th when you go back into the SNF for another 14 days.

In this example, you had 5 days in the hospital which you owe the $1,484 deductible for. Since you hadn’t gone more than 60 days in a row without being either in the hospital or SNF, it’s still under one benefit period. You spent 9 days in a SNF the first time and 14 the second time for a total of 23 days. So, you owe a copay of $185.50 per day for 3 total days.

Just remember, once you’ve gone more than 60 days in a row without inpatient care, the next time you’re admitted to the hospital all of these cost-sharing amounts will start over!

You can see that a hospital stay could run thousands of dollars in out-of-pocket expenses. This is one of the main reasons to get:

Supplemental Coverage to Part A

Although there are several ways to use insurance to help out with hospital costs, the most popular ones are Medicare Supplement (Medigap) Plans and Medicare Advantage Plans…

Medigap Plans

Medigap Plans are supplemental plans to Part A (and Part B) of Medicare which pay for most of the Part A and B deductibles, copays, and coinsurances for you.

The easiest way to show this is to look at the Medigap Plan chart below:

There are several things to notice in the chart:

- Plan A is the only plan that doesn’t pay anything for the Part A deductible

- Every single plan pays for your all of your copays for days 61 – 90, and for your 60 lifetime reserve days

- Every single plan gives you an extra 365 days of coverage if you ever use up all of your lifetime reserve days!

- Plan A and Plan B are the only two plans that don’t pay anything for days 21 – 100 in a SNF

- Plan K and Plan L pay only 50% or 75% respectively for the Part A deductible and SNF copays

So you can see that most Medigap plans pay for all of your Part A cost-shares for you!

But how about…

Medicare Advantage (MA) Plans

Since MA plans technically replace Part A (and Part B) of Medicare, each plan sets its own rules and cost-sharing amounts. These plans definitely have more gaps left over in coverage compared to Medigap Plans:

Hospital Copays

Most MA plans will charge you with daily copays when you’re admitted to a hospital, rather than a traditional deductible.

For example: some plans charge $300 per day up to the first 6 days, then $0 after that. Another plan might charge $425 per day for the first 4 days instead.

SNF Copays

Most MA plans provide little-to-no coverage for SNF stays.

They’ll cover the first 20 days of your stay in a benefit period with $0 copays from you, just like Part A.

However, there is usually very little coverage after that. Depending on the plan, you should expect to pay close to the full daily SNF copay as you would under Part A.

The one thing where MA plans do give you a slight improvement over Part A is that very often they do not require a minimum 3-day hospital stay before you’re covered.

Now that we have a pretty good idea of the basics of what we should know about Part A, let’s look at some common things to watch out for that can hurt you if you’re not careful…

Medicare Part A: Things to Watch Out For

“Observation” vs. Admittance

If you go into the hospital to get treated, do you know when your hospital stay officially starts?

This is important mainly for the “3-day” rule for SNFs that we talked about earlier. If you are not in the hospital as an inpatient for a minimum of 3 days, you will have no medical coverage at all in a SNF.

When you have a scheduled hospital stay, this isn’t so much of an issue. You arrive, you check in, you’re a patient.

However when your stay is a bit more sudden, possibly with a visit to the emergency room first, you might not know when your stay starts.

A lot of times when you go in to the ER and you become an inpatient later, you’re not admitted right away. They may hold you for “observation”, even overnight. And in observation, you’re not yet an inpatient.

If you’re not sure if when your stay started, ask. If you can’t do it for yourself, have a family member find out. They’re also supposed to notify you with a form if you’re in observation for more than 24 hours. This form is called the Medicare Outpatient Observation Notice, or MOON form.

Health Savings Accounts (HSA)

HSAs are financial accounts you can deposit money in each year and use for medical expenses.

One of their biggest benefits is that they have triple tax savings:

In order to contribute in any year to an HSA, you must have a high-deductible health plan. There are yearly limits to how much you can contribute each year, as well.

The thing to be careful of is that you can no longer contribute to an HSA if you are on any part of Medicare, including Part A.

You can still use the funds in the account once you’re on Medicare. You can use them to pay for things like:

- Medicare premiums, deductibles, and copays

- Medicare Advantage and Part D premiums

- Dental and vision expenses

But once you start Medicare, you can’t make contributions.

The main reason it’s important to know this is if you’re still covered by an employer health plan once you’re eligible to start Medicare at age 65 because either you or your spouse are still working.

If you want to keep contributing to an HSA and your health plan doesn’t require that you have it, don’t sign up for Part A.

But what about penalties?

Part A Late Enrollment Penalty

You do not have any Part A late enrollment penalties if you are entitled to premium-free Part A.

But, if you’re in that small percentage that does have to pay for Part A and you don’t sign up when you’re first eligible, you will likely have to pay a penalty whenever you do sign up.

The penalty is a 10% higher premium for twice the number of years you went without it.

For example: if you were eligible for Medicare at 65 and didn’t sign up for Part A until 68, you’ll pay a 10% higher premium for 6 years.

Part A & Social Security Income

Once you’re drawing any form of Social Security income, you’re automatically signed up for Part A. And, you can’t refuse it. You have no choice.

This would only really be an issue if you wanted to keep contributing to an HSA if you’re covered by an employer group health plan and you also want to sign up for Social Security benefits.

Remember, you can’t contribute to an HSA if you’re eligible for Part A, so don’t apply for benefits in this case.

Part A Effective Date is Backdated

One big thing to watch out for is that once you sign up for Medicare after 65 if you’re still covered by a health plan at work is that they backdate your Part A effective date up to 6 months.

Again, this only really affects you if you’re contributing to an HSA.

For example: let’s say you’re working past 65, contributing to an HSA, and now retire on your 68th birthday. You want Medicare to start the next month. Your Part A effective date will actually be backdated 6 months earlier. And, if you’ve been contributing to an HSA up until the time you retire, you’ll likely face an IRS penalty.

To be safe, stop contributing to an HSA at least 6 months before you plan on starting Part A in cases like this.

Well, I think we’ve covered the topic of Medicare Part A pretty thoroughly here. If you have any questions, just send me a message in the box at the bottom of the page or give me a call at 866-240-8639.